Dividends distribution Policy

The Shareholders' Meeting of 21 May 2025 decided on the distribution of a dividend of 0.75 euros per share for the fiscal year 2024. Taking into account the 0.30-euro interim dividend paid on 5 December 2024, the balance of the dividend distributed by the Shareholders' Meeting is 0.45 euros per share and was paid in cash on 5 June 2025.

On 28 July 2025, the Board of Directors decided on the distribution of an interim dividend of 0.30 euros per share. It will be paid in cash on 4 December 2025, with an ex-dividend date on 2 December 2025.

Orange intends, subject to shareholders’ approval, to distribute a dividend floor of 0.75 euros per share for fiscal year 2025 (including the distribution of an interim dividend of 0.30 euros per share in December 2025).

Dividends distribution history

| Fiscal year | Amount per share | Payment date | Means of payment |

|---|---|---|---|

| 2024 | 0.75€ | Interim 0.30€ 5 Dec. 2024 Balance 0.42€ 5 June 2024 |

Cash |

| 2023 | 0.72€ | Interim 0.30€ 6 Dec. 2023 Balance 0.42€ 6 June 2024 |

Cash |

| 2022 | 0.70 € | Interim 0.30€ 7 Dec. 2022 Balance 0.40€ 7 June 2023 |

Cash |

| 2021 | 0.70 € | Interim 0.30€ 15 Dec. 2021 Balance 0.40€ 9 June 2022 |

Cash |

| 2020 | 0.70 € + 0.20 € | Interim 0.40€ 9 Dec. 2020 Balance 0.50€ 17 June 2021 |

Cash |

| 2019 | 0.50 € | Interim 0.30€ 4 Dec. 2019 Balance 0.20€ 4 June 2020 |

Cash |

| 2018 | 0.70 € | Interim 0,30€ 6 Dec. 2018 Balance 0,40€ 6 June 2018 |

Cash |

| 2017 | 0.65 € | Interim 0,25€ 7 Dec. 2017 Balance 0,40€ 7 June 2018 |

Cash |

| 2016 | 0.60 € | Interim 0,20€ 7 Dec. 2016 Balance 0,40€ 14 June 2017 |

Cash |

| 2015 | 0.60 € | Interim 0,20€ 9 Dec. 2015 Balance 0,40€ 23 June 2016 |

Cash |

| 2014 | 0.60 € | Interim 0,20€ 9 Dec. 2014 Balance 0,40€ 10 June 2015 |

Cash |

| 2013 | 0.80 € | Interim 0,30€ 11 Dec. 2013 Balance 0,50€ 5 June 2014 |

Cash |

| 2012 | 0.78 € | Interim 0,58€ 12 Sept. 2012 Balance 0,20€ 11 June 2013 |

Cash |

| 2011 | 1.40 € | Interim 0,60€ 8 Sept. 2011 Balance 0,80€ 13 June 2012 |

Cash |

| 2010 | 1.40 € | Interim 0,60€ 2 Sept. 2010 Balance 0,80€ 15 June 2011 |

Cash |

| 2009 | 1.40 € | Interim 0,60€ 2 Sept. 2009 Balance 0,80€ 17 June 2010 |

Cash |

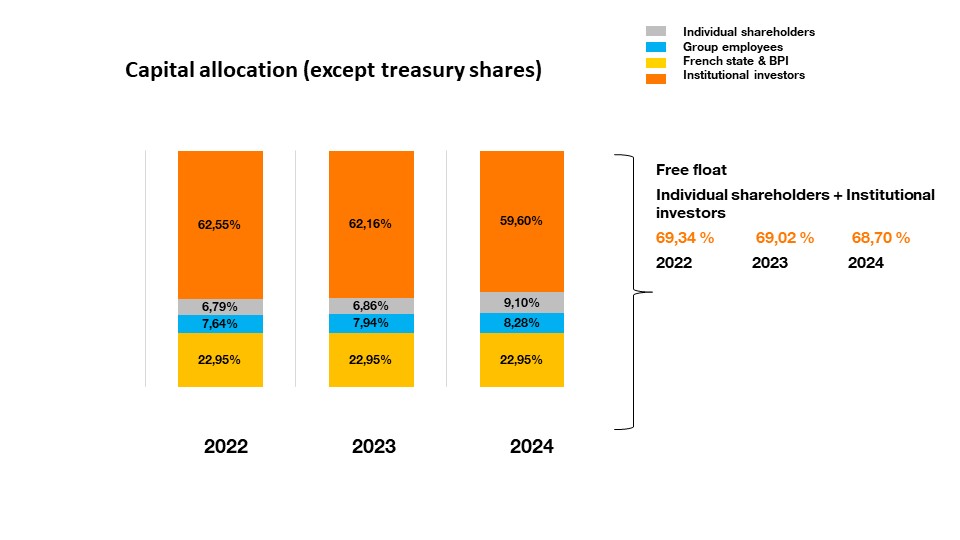

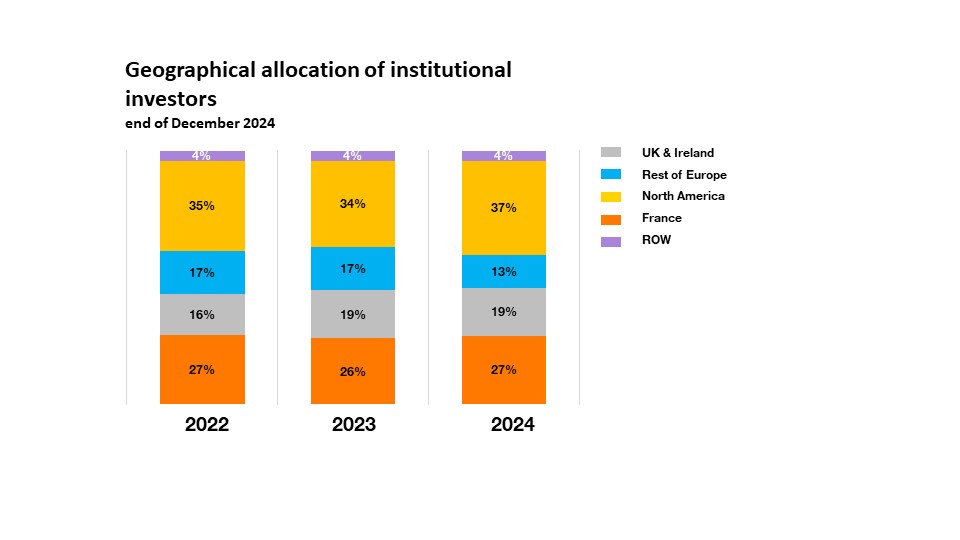

Capital allocation

Institutional investors and others legal entities allocation estimate on the basis of the TPI survey (12/31/2024).

Consensus

Orange has compiled a consensus for Q3 2025 and FY 2025 based on the 12 estimates received as of 8th October 2025.

The detailed consensus is available in the Investors Library and below.

| Indicators In €m |

H125 Median |

2025 Median |

|---|---|---|

| Revenues | 9,965 | 40,237 |

| EBITDAaL (excluding Spain) | 3,428 | 12,435 |

| EBITDAaL telecom activities (excluding Spain) | 3,446 | 12,506 |

| eCAPEX Group (excluding Spain) | 1,385 | 6,240 |

| Organic cash flow - continuing operations (excluding Spain) | 3,628 | |

| Free Cash Flow "all in" - continuing operations (excluding Spain) | 2,767 |

Detailed consensus files :

Share buyback program

Information on transactions carried out by Orange as part of its share buyback programs are available in our Investors’ library.

Liquidity contract

Half-yearly reports on the Orange liquidity contract are available in our Investors’ library.

Find all the information available for investors and analysts.

Investors' Library

Find all our latest financial information as well as our document library for investors and analysts.